Acquiring a genuine estate license is not without training and practice. Depending on the state in which you live or plan to practice, you will be needed to enlist in a particular quantity of training. Instead of looking at this as a pricey endeavor, investors should consider the various methods this education will benefit their investing profession. After all, one of the crucial elements of being an effective business owner is consenting to never ever stop finding out and enhancing yourself. When asking, "is it worth it getting Website link a property license?", think about how the hours of training could boost your genuine estate knowledge, investing lingo, and entrepreneurial spirit.

There are factors both for and against the questions. Nevertheless, I would be remiss if I didn't at least identify the "failures" of getting your property license. Keep in mind, there are two sides to every coin. While I strongly encourage financiers to think about getting their licenses, specific elements warrant your factor to consider. There is an argument to be made for not getting your license, or at least holding off. However, becoming a licensed property agent does not necessarily accompany downfalls, but rather challenges at the point of entry. Listed below you will find a couple of the reasons individuals may not wish to get their real estate license: Becoming a certified genuine estate representative does not come complimentary; you should invest a good deal of time, energy, and even money to practice regularly.

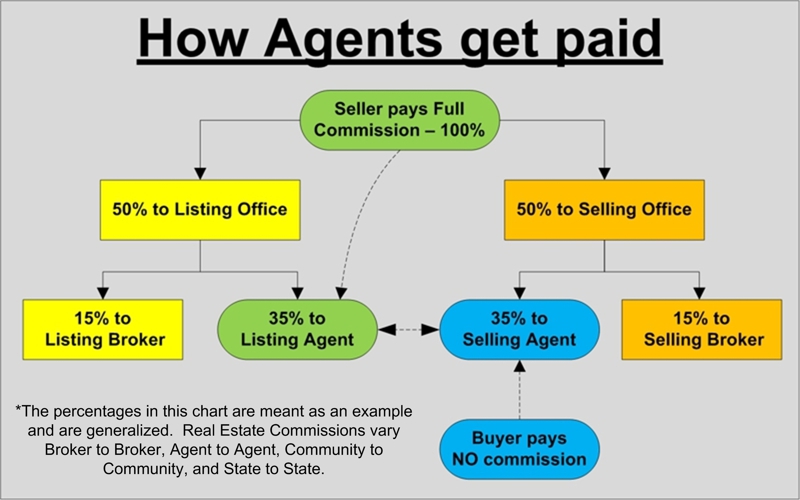

What's more, you will be expected to continue your education to maintain to date with the current modifications in the industry. Some brokerages will require you to acquire a yearly subscription with the National Association of Realtors (NAR) or even insure yourself. While having a real estate license can certainly help your investing career, it is very important to acquaint yourself with in advance expenses and time investments. In some states, it can cost as much as $1,500 in a given year simply to get and keep your license. Do not let these expenses capture you off guard. A few of the most common costs are MLS fees, lockbox fees, realtor designation costs, and broker commissions.

While not having your own realty license will imply you need to rely on others, it is entirely possible to deal with a skilled realty representative that http://johnnyoltd695.timeforchangecounselling.com/what-is-pmi-in-real-estate-truths brings your service to the next level (What does a real estate broker do). What's more, not needing to stress over the requireds of ending up being a representative will enable you to concentrate on what truly matters: income-producing investing activities. For what it's worth, getting your genuine estate license as a financier has significant advantages. Learning how to end up being a real estate investor includes acquainting yourself with what is needed to end up being a certified representative. The coursework and certification processes will vary by state, a barrier to entry that can scare numerous investors from making a good choice.

This opportunity might broaden your education, network, reliability, and more. By evaluating these pros and cons, financiers can make an informed choice on whether or not getting a realty license is worth it. Whether you're brand name new to investing or have closed a few deals, our brand-new online real estate class will cover everything you require to understand to help you begin with real estate investing. Professional financier Than Merrill discusses the very best realty techniques to help get you on the course towards a better monetary future.

Successful financiers tend to buy and sell multiple properties in a brief period of timeand deal with the very same representative to do someaning this could be a consistent stream of earnings for you. Wish to become their go-to agent? Consider these 7 ideas. Financiers go over things like ROI, cap rates, 1031 exchanges, cash-on-cash returns, and net present worth. (If you need to deal with your continuing education to speak the same language, have a look at some of the available CE courses.) Understand what matters to them. They do not most likely appreciate the existing paint or carpet colors. They just care if the walls require to be repainted, if the restroom requires to be updated, and most notably, just how much will it cost - What is mls real estate.

Fascination About How Much Do Real Estate Brokers Make

You require to comprehend your customer's financial investment method: Buy, fix, and flip? Purchase at wholesale and sell to another investor? Purchase, rehab, and lease?: Learn how to earn 5% more for every listing with this. What's their investment horizon? Is this a long-term hold with a five- to ten-year profit window, or does the financier need to offer the residential or commercial property before purchasing another one? The more you know about your investor's timeline, the better you can be. Learn how to use the many estimations offered to evaluate and select property financial investment residential or commercial properties. The relationship in between financier client and representative will be strengthened if you can find suitable homes and assist analyze their roi.

What areas are hot right now? What areas are up-and-coming? Where are the best schools? Where are the new jobs located? Assist determine those opportunities and present homes for your investor to consider. As soon as you understand their objectives and can help identify appropriate properties, search for additional methods to include value to your services. One way to do this is by comprehending their discomfort points and recommending resources (What does contingent in real estate mean). Do they need an excellent handyman? Quotes from painters? Flooring quotes? A tax advisor? Be their go-to source for these recommendations. Joining a real estate financier group in your location is an excellent way to find prospective customers, discover what financiers in your area are trying to find, and provide your insight on potential properties.

To end up being an investor, there is a couple of actions you need to take. The very first one, you've got to get yourself educated. Now, there are all sorts of live education events that are excellent location to receive some incredible education, and there are many books out there consisting of the book I composed called the. You've really got to make the the numbers. What does it indicate to crunch them? What does it indicate to find a bargain? What does it mean to evaluate the offer? Therefore, make it an indicate either go to a live event or get a copy of a number of genuine estate books and as you check out View website those, it's going to get you educated.

The second thing. Now, the most bare bones fundamental group would include a property supervisor, a loan officer and a real estate agent, now not simply any of those. You're gon na wish to look, for instance initially, for a realtor that specializes only on investment homes, all right? They need to show you a long performance history in history which they have a performance history of finding actually excellent offers and to prove that they've got really good deals. The 2nd thing you require as an investor is a. It's something to certify for one home; it's another thing to qualify for lots of houses.